Used Bonds to Issue New Mortgages to Families Currently in Default and to Prevent Foreclosure.

What is Yield to maturity?

Yield to Maturity refers to the expected returns an investor anticipates after keeping the bail intact till the maturity date. In other words, a bond's expected returns after making all the payments on fourth dimension throughout the life of a bail. Unlike current yield The current yield formula substantially calculates the yield on a bond based on the marketplace toll instead of face value. The electric current yield of bond= Annual coupon payment/current market price read more The current yield formula essentially calculates the yield on a bond based on the market place cost instead of face value. The current yield of bail= Annual coupon payment/current market place price read more , which measures the present value of the bond, the yield to maturity measures the value of the bond at the end of the term of a bail.

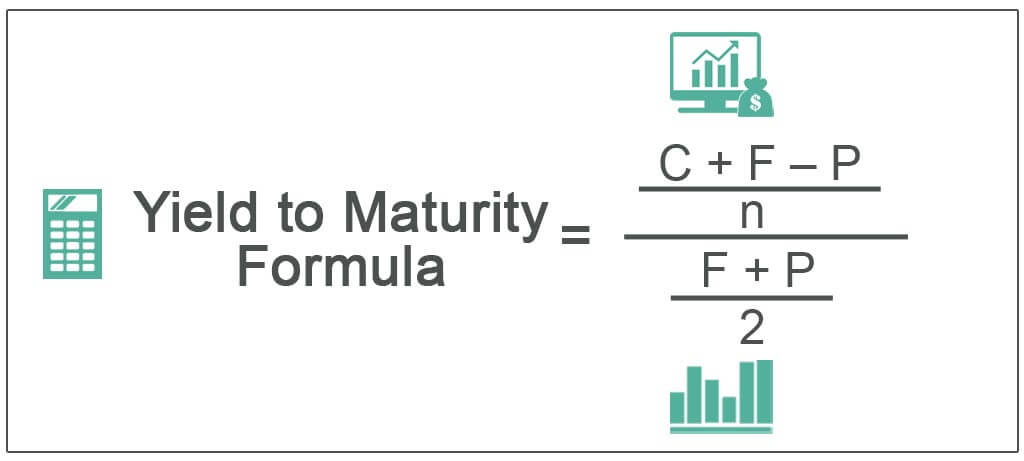

Yield to Maturity Formula

YTM considers the constructive yield Effective yield is a yearly rate of return at a periodic involvement charge per unit proclaimed to exist one of the constructive measures of an equity holder's return as information technology takes compounding into its due consideration, unlike the nominal yield method. read more than of the bail, which is based on compounding Compounding is a method of investing in which the income generated by an investment is reinvested, and the new principal corporeality is increased by the amount of income reinvested. Depending on the time period of deposit, interest is added to the principal amount. read more . The below formula focuses on calculating the approximate yield to maturity, whereas calculating the actual YTM volition crave trial and error by considering different rates in the electric current value of the bond until the price matches the actual market cost of the bail. Nowadays, there are computer applications that facilitate the easy to calculate YTM of the bail.-

Yield to Maturity Formula = [C + (F-P)/due north] / [(F+P)/2]

Where,

- C is the Coupon.

- F is the Face Value of the bond.

- P is the current marketplace price.

- n will be the years to maturity.

You are free to use this image on your website, templates etc, Delight provide the states with an attribution link Article Link to be Hyperlinked

For eg:

Source: Yield to Maturity (wallstreetmojo.com)

The formula below calculates the bail's present value. If you lot have the bond's present value, you can summate the yield to maturity (r) in contrary using iterations.

Present Value of Bond = [C / ( 1+r )] + [C / ( 1+r )^two] . . . . . . [C / ( 1+r )^ t ] + [F / ( 1+r )^ t ]

Stride past Pace Calculation of Yield to Maturity (YTM)

The steps to calculate Yield to Maturity are equally follows.

- Gathered the information on the bond-like its face value, months remaining to mature, the electric current market price of the bail, the coupon rate of the bond.

- Now calculate the almanac income available on the bond, which is more often than not the coupon, and it could be paid annually, semi-annually, quarterly, monthly, etc. and appropriately, the calculation should exist made.

- Likewise, i needs to amortize the discount or premium, which is a difference between the face value of the bond and the electric current market price over the life of the bond.

- The numerator of the YTM formula volition be the sum of the amount calculated in steps two and pace 3.

- The denominator of the YTM formula will be the average of toll and face value.

- When one divides pace 4 past step 5 value, it shall be the estimate yield on maturity.

Examples

You tin download this Yield to Maturity (YTM) Formula Excel Template here – Yield to Maturity (YTM) Formula Excel Template

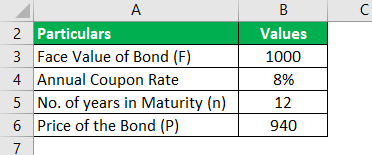

Example #i

Assume that the price of the bond is $940, with the confront value of the bond $k. The almanac coupon rate is 8%, with a maturity of 12 years. Based on this data, you are required to summate the guess yield to maturity.

Solution:

Use the below-given data for adding of YTM

We can use the above formula to calculate approximate yield to maturity.

Coupons on the bond Coupon bonds pay fixed involvement at a predetermined frequency from the bond's result date to the bond'due south maturity or transfer date. The holder of a coupon bond receives a periodic payment of the stipulated fixed interest charge per unit. read more will exist $ane,000 * 8%, which is $80.

Yield to Maturity (Approx) = (lxxx + (1000 – 94) / 12 ) / ((1000 + 940) / 2)

YTM will be –

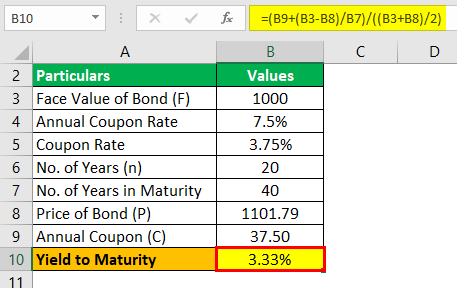

Example #ii

FANNIE MAE Fannie Mae, i.due east., Federal National Mortgage Association is a United States government-sponsored enterprise (GSE) which was founded in the yr 1938 by congress to boost the secondary mortgage market place during the keen depression which involves financing for the mortgage lenders thereby providing access to affordable mortgage financing in all the markets at all times. read more is i of the famous brands that are trading in the United states of america market place. The government of the U.s. at present wants to result 20 year fixed semi-annually paying bail for their projection. The price of the bond is $1,101.79, and the confront value of the bond is $ane,000. The coupon charge per unit is seven.5% on the bond. Based on this information, you are required to calculate the judge yield to maturity on the bond.

Solution:

Apply the below-given data for calculation of yield to maturity.

Coupon on the bond will exist $one,000 * 7.5% / 2 which is $37.50, since this pays semi-annually.

Yield to Maturity (Approx) = ( 37.50 + (thou – 1101.79) / (twenty * 2) )/ ((yard + 1101.79) / 2)

YTM will be –

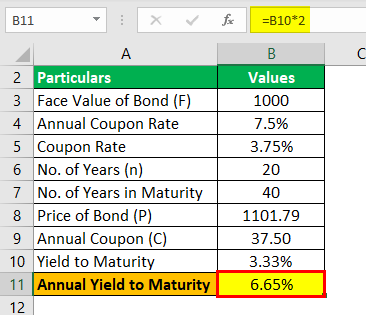

This is an approximate yield on maturity, which shall be three.33%, which is semiannual.

Annual YTM will be –

Instance #three

Mr. Rollins has received the lump sum amount in the form of the lottery. He is a risk-averse person and believes in low risk and loftier return. He approaches a fiscal counselor, and the advisor tells him that he is the incorrect myth of depression hazard and high returns. Then Mr. Rollins accepts that he doesn't like hazard, and low-risk investment Low-risk investments are the financial instruments with minimal uncertainties or chances of loss to the investors. Although such investments are condom, they fail to offer high returns to the investors. read more with a low return will exercise. The advisor gives him two investment options, and the details of them are below:

Both the coupons pay semi-annually. Now Mr. Rollins is perplexed which bond to select. He asks Advisor to invest in option 2 as the price of the bond is less, and he is ready to sacrifice a 0.50% coupon. Nonetheless, Counselor tells him instead to invest in option one.

You are required to validate the advice made by the advisor.

Solution:

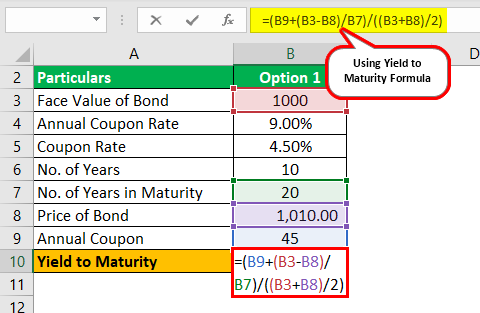

Option 1

Coupon on the bond will be $1,000 * 9% / two which is $45, since this pays semi-annually.

Yield to Maturity (Approx) = (45 + (yard – 1010) / (10 * 2)) / (( 1000 +1010 )/2)

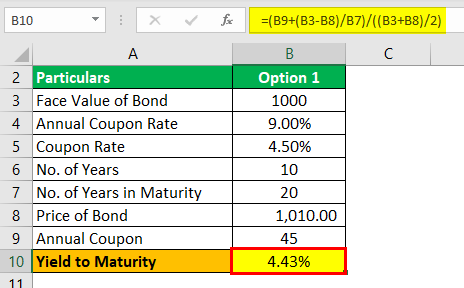

YTM will exist –

This is an approximate yield on maturity, which shall be four.43%, which is semiannual.

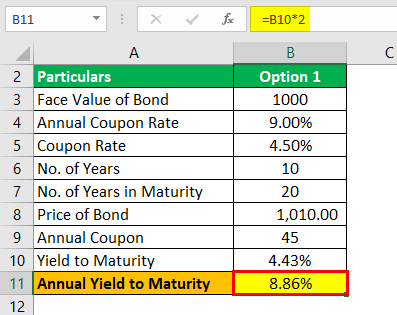

Almanac YTM volition be –

Therefore, the annual Yield on maturity shall be 4.43% * two, which shall be 8.86%.

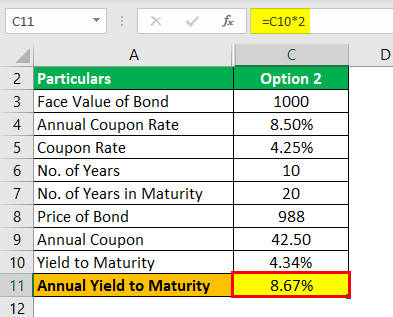

Option 2

Coupon on the bond volition exist $one,000 * 8.fifty% / 2 which is $42.five, since this pays semi-annually.

Yield to Maturity (Approx) = (42.50 + (grand – 988) /(10 * 2))/ (( 1000 +988 )/2)

This is an approximate yield on maturity, which shall be iv.34%, which is semiannual.

Annual Yield to Maturity volition be –

Therefore, the annual Yield on maturity shall exist 4.34% * 2, which shall be viii.67%.

Since the yield on maturity is college in pick two; hence the advisor is correct in recommending investing in option 2 for Mr. Rollins.

Relevance and Uses

- Yield to maturity allows an investor to compare the present value of the bond with other investment options in the market.

- TVM The Time Value of Money (TVM) principle states that coin received in the nowadays is of higher worth than money received in the future because money received now can be invested and used to generate greenbacks flows to the enterprise in the future in the form of interest or from future investment appreciation and reinvestment. read more (Time value of coin) is taken into consideration while calculating YTM, which helps in better analysis of the investment with regards to a futurity return.

- It promotes making credible decisions as to whether investing in the bond will fetch skilful returns equally compared to the value of the investment at the current state

Recommended Articles

This has been a guide to yield to maturity (YTM). Hither we discuss how to calculate yield to maturity of the bond using its formula along with practical examples and a downloadable excel template. Y'all tin can learn more than about economics from the following articles –

- Yield to Call Adding

- Current Yield of a Bail Adding

- Yield to Worst

- Calculate Yield in Excel

Source: https://www.wallstreetmojo.com/yield-to-maturity-ytm-formula/

0 Response to "Used Bonds to Issue New Mortgages to Families Currently in Default and to Prevent Foreclosure."

Post a Comment